Although we touched on how to calculate employee salaries in the previous article, this time we will answer your questions about EPF and SOCSO contributions.

“Are these EPF and SOCSO contributions very important for employees? If it is important, is the employer the only one who needs to contribute? And how much must be paid? If you don’t want to contribute, is it wrong?“

If you want to know all the answers to those questions, you have to read to the end. This information is very valuable because these contributions are very useful for every employee and employer.

What is EPF’s Contribution?

We often hear EPF mentioned, but do you know what EPF’s contribution is?

Employee Provident Fund (EPF) or Kumpulan Wang Simpanan Pekerja (KWSP) is a contribution that must be paid by employers and employees under Section 43(1), EPF Act 1991 which obliges employees and employers to pay monthly contributions with the amount of wages in that month according to the rate has been stated in the Third Schedule.

For your information, the employer and employee contribution amounts are different. The employer has to pay 13% of the employee’s basic salary, while 11% will be deducted from the employee’s basic salary. “Oh, how is that? I do not understand“

Well, here’s an easy way to understand. Let’s say the basic salary of an employee is RM3,000. So, the employer has to pay 13% of the basic salary, while 11% will be deducted from the basic salary.

13% x RM3,000 = RM390 (This is the employer’s share which is the amount of contribution that must be paid by the employer)

11% x RM3,000 = RM330 (While this is the contribution amount that will be deducted from the employee’s basic salary)

Easier to understand, right? However, this contribution rate needs to be referred back to the Third Table for a more accurate amount.

In addition, the contribution amount must be paid in full ringgit value and no cent value is allowed. In simple words, employer and employee shares are not allowed to be made based on the exact percentage except for those whose wages exceed RM20,000. This means the amount of sen has to be rounded to the next ringgit value. For example,

13% x RM2,520 = RM327.60 (after rounding you will get as much as RM328)

Do only citizen employees need to contribute?

No, for EPF contribution, non-citizen employees can also contribute and employers contribute. However, contributions to non-citizen employees are optional. This contribution can be made after both the employer and employee agree to contribute.

SOCSO and EIS contributions

If earlier the EPF contribution had a fixed contribution rate, right? But, for SOCSO, the contribution is according to the employee’s salary scale.

For your information, the Social Security Organization (SOCSO) is a Malaysian government agency established to provide social security protection to Malaysian workers under the Workers’ Social Security Act, of 1969. There are two types of contributions under SOCSO, namely SOCSO contributions and the latest EIS.

What is SOCSO?

SOCSO, or Social Security Organization is a contribution under SOCSO. As mentioned earlier, this SOCSO is slightly different from the EPF. The total SOCSO contribution rate is based on the employee salary scale provided by SOCSO.

Let’s take the example of the basic salary of RM3,000 and check it on the employee salary scale that has been prepared. The salary is included in the 35th group which sets the employer’s share at RM53.35, while the employee’s share is RM15.25.

Therefore, the contribution rate is the one that needs to be contributed by the employee and also the employer for the SOCSO contribution.

What about SIP?

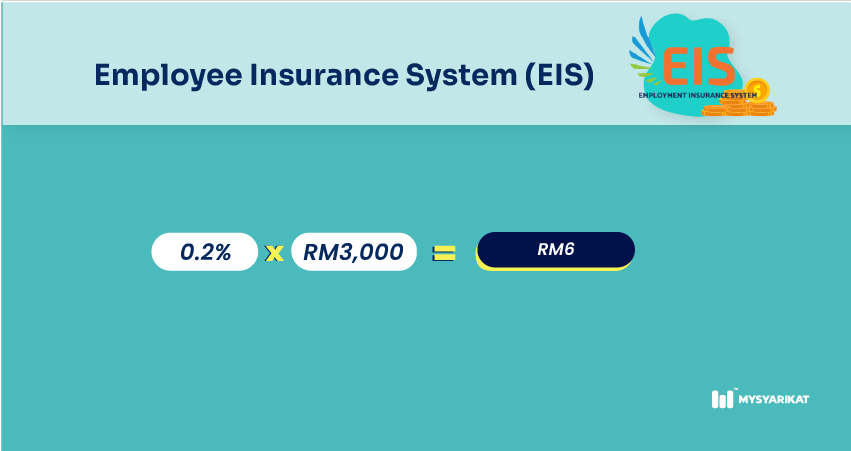

The Employee Insurance System (EIS) is the latest SOCSO contribution that provides a replacement for Insured Persons (IP) who lose their jobs. This contribution sets an equal share contribution rate for employers and employees which is 0.2% of the employee’s basic salary. Let’s say the employee’s basic salary is RM3,000.

0.2% x RM3,000 = RM6

Therefore, the total share contribution rate of the employer and employee is only RM6.

Contribution Rate Payment Period

The employer must pay the contribution rate that has been set no later than 15 days of the month for the contribution for the previous month. For example, the contribution for January must be completed no later than 15 days of the month in February.

The payment period is the same for EPF, SOCSO, and EIS contributions.

Late Contributions Payment or Delay

Failure or delay in paying the contributions is considered an overdue contribution.

For EPF contributions, late payment charges will be charged to the employer. The late charge rate is charged based on the lowest dividend between Simpanan Konvesional and Simpanan Shariah for each year for the one percent addition rate.

The minimum amount of the charge is as much as RM10 and if there are cents in the charge, the amount needs to be rounded up to a higher ringgit value.

Meanwhile, for SOCSO and EIS, late payment interest will be charged at 6% per annum for each day the contribution is not paid within the specified payment period.

Automate Contributions Payment with MySyarikat

Once the contributions have been totaled for your employees. Make sure you record every credit and debit of your company’s finances to ensure there are no problems later on. Want it easier and faster?

Just ask for help from us at MySyarikat. Our organized system makes it easy for you to use every function and feature available. It is no longer necessary to key in your employees’ data one by one. With just one click, everything is recorded!

Come on, register with MySyarikat now!

Selamat Sejahtera .

Tuan/Puan

kami ada syarikat yang menggunakan sub-contaractor pekerja . Adakah perlu membuat potongan perkeso. Syarikat ini baru 2 Tahun operasi. Oleh kerana kurang production kami hanya gunakan sub contractor saja perkerja.

Sekian Terima Kasih

PERKESO adalah caruman sebahagian daripada caruman wajib. Majikan wajib untuk membuat caruman PERKESO bagi pekerja yang bekerja di Malaysia.