The amendment of the Employment Act 1955 in 2022 has touched on various clauses such as reducing working hours, increasing the amount of maternity and paternity leave, and so on.

One of the things that attracted a lot of attention was the minimum wage for private-sector employees. It stated that employers under five employees must pay a minimum salary of RM1,500. However, the enforcement of the act was postponed to July 2023.

Employers should note that the postponement is only for employers who employ less than five people. If you use more than five people, enforcing the minimum wage of RM1,500 is mandatory from 1 May 2022. If you are an employee and receive less than the amount due, complain to the Department of Labor.

How To Correctly Calculate Employee’s Salary

Some employers do not bother with the correct and accurate calculation method in payroll management. Some only consider the employee’s monthly gross salary as well as contributions without knowing the right SOP of salary calculation subject to the act.

If you are found to be paying workers wages not covered by the act, sooner or later you will be fined and be prepared to pay taxes for your negligence. Let’s check the correct way to calculate the employee’s salary!

i) Employee Attendance

Generally, your employee’s salary will not be the same every month if they do not meet the set attendance that month. As an employer or HR, you need to check every month whether your employees take MC, emergency leave (EL), or leave without a reasonable reason.

If the amount of annual MC allocated by your company has been used up by your employees, salary deductions can be made according to the amount of their absence. However, this salary denial can still be avoided at your discretion as the employer.

As for EL, not all company policies provide it for employees. So, as an employer, you can also refuse the salary of employees who regularly take EL without showing reasons and strong evidence. However, the average company now sets the amount of EL that employees can take to make it easier for them to manage and solve the problems they face.

The formula for calculating the basic salary after taking into account their attendance is as follows:

Employee’s Gross Salary / Number of Days in the Month x Number of Days the Employee Works

Example: RM2,000 / 30* = RM66.67 x 24 = RM1,600

*The number of days depends on the number of days in the month (28/29/30/31)

RM1,600 is the employee’s basic salary and the amount subject to contribution.

ii) Mandatory Contribution For Employees

As an employer, you must know the three mandatory contributions for employees in Malaysia. These contributions are mandatory for employers and employees to pay every month.

- Employees’ Provident Fund (EPF)

EPF contributions or KWSP should be paid by the employer as much as 13%, while 11% will be deducted from the employee’s basic salary.

This contribution is subject to Section 43(1), EPF Act 1991 which stipulates that every employee and employer to a person who is an employee within the meaning of this act must be responsible for paying a monthly contribution to the amount of wages for that month at the rate that each specified in the Third Schedule.

The calculation method is as follows (take the example above):

13% x Basic Salary of the Employee (a contribution that must be paid by the employer)

11% x Employee Basic Salary (contribution deducted from employee salary)

13% x RM1,600 = RM208 and 11% X RM1,600 = RM176

- Social Security Organization (SOCSO)

SOCSO was established to administer and implement social security schemes under the Workers’ Social Security Act 1969. Two contributions must be paid under PERKESO, namely SOCSO and EIS.

For SOCSO, the amount of contributions by employers and employees is slightly different compared to EPF because it follows the employee salary scale that has been set by SOCSO. Let’s take the example of a base salary of RM1,600 and refer to the salary scale of SOCSO employees.

The basic salary falls under the category “Salary exceeding RM1,500 but not exceeding RM1,600”. So the employer’s share is as much as RM27.15, while the employee’s share is as much as RM7.75.

The Employee Insurance System (EIS) is SOCSO’s latest contribution scheme which stipulates that the share contribution of employers and employees is the same, which is 0.2% of the employee’s basic salary.

This means that the employer and employee’s share is as much as RM3.20 if we take an example from the basic salary of RM1,600 earlier (Employee’s Basic Salary x 0.2%)

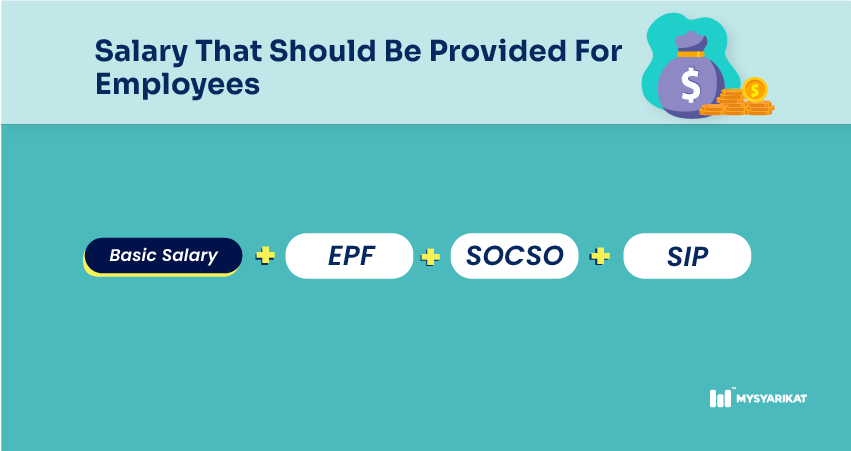

So, how much salary should be provided for employees?

In conclusion, the wages that must be provided for employees by employers are:

Basic Salary + EPF + SOCSO + SIP

We can take the example of the base salary of RM1,600 earlier.

RM1,600 + RM208 + RM27.15 + RM3.20 = RM1,838.55 (employer must provide)

This is the amount that the employer must provide for the employee, but the amount that the employee gets after the deduction of contribution, the employee will get the amount as follows:

Basic Salary – EPF – SOCSO – SIP = Monthly Salary

RM1,600 – RM176 – RM7.75 – RM3.20 = RM1413.05 (employee’s monthly salary)

Salary Payment Period

Subject to Section 18 of the Employment Act 1955, the wage payment period cannot exceed one month and according to Section 19 in the act, the payment period cannot be later than the seventh day after the last day of any wage period.

Employers are recommended to pay employees’ salaries between the 1st and 5th of each month to ensure the company’s financial reports are more structured and organized.

In addition, employers need to provide salary statements to employees as stipulated in Regulation 9, Labor Regulations 1957 (Peraturan-Peraturan Kerja 1957). Failure to do so may result in a fine if the employee files a complaint with the Labor Department.

Salary payments to employees must be made through the employee’s bank account as stipulated in Section 25 of the act. However, the employer can pay the employee’s salary using a check or in cash on the condition of getting a letter of consent from the employee himself.

Automate Your Salary Management with MySyarikat!

If you are still in doubt about calculating the total employee salary, quickly get help from us at MySyarikat. Embrace the power of technology and transform your HR department into a well-oiled machine.

With the best HR software in Malaysia –MySyarikat– you can streamline your HR processes, save time and costs, improve accuracy and compliance, and enhance the overall employee experience.

Book a ‘Demo Session‘ with us now and experience the MySyarikat system yourself!

For Clerk work… Basic salary RM1500… May I know the reason my employer deduct for Sunday?

I’m not sure why, it is advice to ask HR and employer for the reason ya.

If you divide by the number of days in the month then definitely sundays will be deducted because we dont work on sundays..shouln’t it divide by 26 days instead (working days only)

The calculation are based on general working days in Malaysia (Saturday and Sunday is not working days). If we calculate common working days (Sunday is not working day) then it will be divide by 26 days.